Draft directions for type 941 now embrace a draft of worksheet 1, credit score for certified sick and household go away wages and the worker retention credit score. These are reported individually from the sick/household go away credit and it is very important individually calculate any credit associated to this provision.

Letter C Worksheets for Kindergarten Worksheet for

Letter C Worksheets for Kindergarten Worksheet for

Line 13d (refundable portion of worker retention credit score from worksheet 1).

941 worksheet 1 draft. These bills are usually allocable to the wages reported on type 941, half 3, line 21. Submitting type 941 is simple with taxbandits new zero submitting characteristic; Additional, the brand new entries partly three of the draft type 941 require employers to offer data in reference to:

Column 2 is the quantity from column 1 multiplied by 0.062. All that you must learn about type 941 worksheet 1, 2020. The draft directions embrace a worksheet (worksheet 1) to assist with the computations.

The irs has now printed the draft of the shape 941 [1] for use for the remainder of 2020. Nonrefundable portion of worker retention credit score from worksheet 1. July 2020) employer's quarterly federal tax return division of the treasury inside income service.

Based mostly on the draft type 941 issued on april 30, 2020 and linked above, this will likely be calculated on the brand new worksheet 1 that can should be connected to any 941 utilizing payroll tax associated credit. The draft model doesn’t include any modifications. 13d, to report the refundable portion of the worker retention credit score from worksheet 1.

The brand new type takes under consideration the modifications made by the households first coronavirus response act and the coronavirus help, reduction, and financial safety act that added numerous varieties of payroll tax reduction. The federal revenue tax withholding tables are included in pub. Draft as of directions for type 941 (rev.

Irs launched a brand new draft of the shape 941. On april 30, 2020, the irs launched a draft of the shape 941 for 2020. This worksheet has 3 steps relying on what sort of tax credit enterprise homeowners are eligible for.

Whereas that is only a draft and never supposed for precise submitting, it does give companies an concept of what they will count on when submitting sooner or later. To print the 941 worksheet. The irs has launched a draft model of the up to date type 941 (plus directions).

11b nonrefundable portion of credit score for certified sick and household go away wages from worksheet 1 11b. Solely sure steps of the worksheet will likely be accomplished relying on which sort of certified wages the employer paid throughout the quarter: To print the 941 worksheet for every division to which staff are assigned, choose the division.

The highest 10 causes to file type 941 with taxbandits; | 05/01/20 on the finish of april, the irs issued drafts of the 2020 type 941 , employer’s quarterly federal tax return , and its directions for use starting with the second quarter return (april 1 to june 30) that should be filed by july 31. On line 22, enter the certified well being plan bills for the erc.

It’s mandatory to finish worksheet 1 earlier than getting ready the shape 941. Employers report the refundable portion of the worker retention credit score from worksheet 1 on line 13d. Don’t overlook worksheet 1 once you file your type 941 this quarter!

The refundable portion of the credit score is allowed after the employer share of social safety tax reported on type 941, traces 5a and 5b, is diminished to zero by. (see draft type 941 directions, pg. To perform the incorporation of the varied incentive packages into payroll tax compliance course of, the interior income service has launched a draft of the revised type 941, employer’s quarterly federal tax return and its directions for 2020.

Accounting cs performs this calculation for you. If you want, you may submit feedback to the irs in regards to the draft type or directions at irs.gov/formscomments. Nonrefundable portion of credit score for certified sick and household go away wages from worksheet 1.

The revised type needs to be used beginning with the second quarter of 2020 (april 1 to june 30). Substantial modifications have been proposed to irs type 941, which was launched in draft type on april 29, 2020, with draft directions launched on could 1, 2020. The next are the hyperlinks to the draft variations of the 941 worksheet and return • 941 return • directions for type 941, together with the worksheet for credit score for sick and household go away wages and the worker retention credit score type 7200 when you have elected to obtain a tax credit score paychex will apply the quantity of the credit to your federal tax

Directions for type 1041, u.s. Half 1, line 13d, is the place employers report the refundable portion of the worker retention credit score from worksheet 1. Advances acquired from submitting type 7200 for the quarter (line 13f).

Additionally enter the quantity from line 22 on worksheet 1, step 3, line 3b. Half 4 is used if you wish to designate an worker or paid preparer or service to speak with the irs about type 941. Type 941 line 5a(i) choose up $180 for this payroll test and $20 will likely be included in worksheet 1 line 2a(i).

The quantity from line 25 can also be entered on worksheet 1, step 3, line 3d. Nonetheless, the irs is more likely to require it within the case of an audit. The modifications are essential to account for and reconcile ffrca and cares act tax credit, in addition to advance funds of such credit utilizing type 7200.

Additionally enter this quantity on worksheet 1, step 3, line 3a. Underneath generate stories, click on the stories tab.; On the 941 tab, choose print 941 worksheet.;

13f, to report complete advances acquired from submitting type(s) 7200 for the quarter. The draft model of the shape doesn’t include any modifications to half 2 of the shape. Half 1, line 13f, is the place employers report complete advances acquired from submitting type(s) 7200 for the quarter.

Steps 1, 2, and three will likely be accomplished when an employer paid within the quarter certified sick and household go away wages in addition to. The refundable portion of tax credit as calculated in worksheet 1 (traces 13c and line 13d); Worksheet 1 is retained within the employer's data and isn’t filed with the irs;

We’ll use the finished voucher to credit score The worksheet is used to find out quantities relevant to a number of the new traces for the revised type 941.

Seasonal and Vacation Following Path Worksheets BUNDLE

Seasonal and Vacation Following Path Worksheets BUNDLE

An Simple Character Improvement Worksheet…Plus One Secret to

An Simple Character Improvement Worksheet…Plus One Secret to

6 Superior Writing Ideas for Ending Your First Draft

6 Superior Writing Ideas for Ending Your First Draft

ACE Writing Technique poster / handout / worksheet in 2020

ACE Writing Technique poster / handout / worksheet in 2020

College Grammar for teenagers, English workouts, College topics

College Grammar for teenagers, English workouts, College topics

FREE Running a blog Planner Inserts & Organizers Weblog planner

FREE Running a blog Planner Inserts & Organizers Weblog planner

Pin on Customise Design Worksheet On-line

Pin on Customise Design Worksheet On-line

Thanksgiving Turkey Writing Paper (With pictures) Turkey

Thanksgiving Turkey Writing Paper (With pictures) Turkey

Fall Hint and Coloration Music Worksheets (с изображениями

Fall Hint and Coloration Music Worksheets (с изображениями

The place is the animal English ESL Worksheets for distance

The place is the animal English ESL Worksheets for distance

Take pleasure in & Share 3 Inspiring Lent Pictures Foster parenting

Take pleasure in & Share 3 Inspiring Lent Pictures Foster parenting

fill within the lacking numbers 150 free printable worksheet

fill within the lacking numbers 150 free printable worksheet

4 Digit Place Worth Distance Studying Worksheets, Video games

4 Digit Place Worth Distance Studying Worksheets, Video games

Further Cash Earned Worksheets Better of Change Your

Further Cash Earned Worksheets Better of Change Your

Free Printable Adjective Worksheets Adjective Worksheets

Free Printable Adjective Worksheets Adjective Worksheets

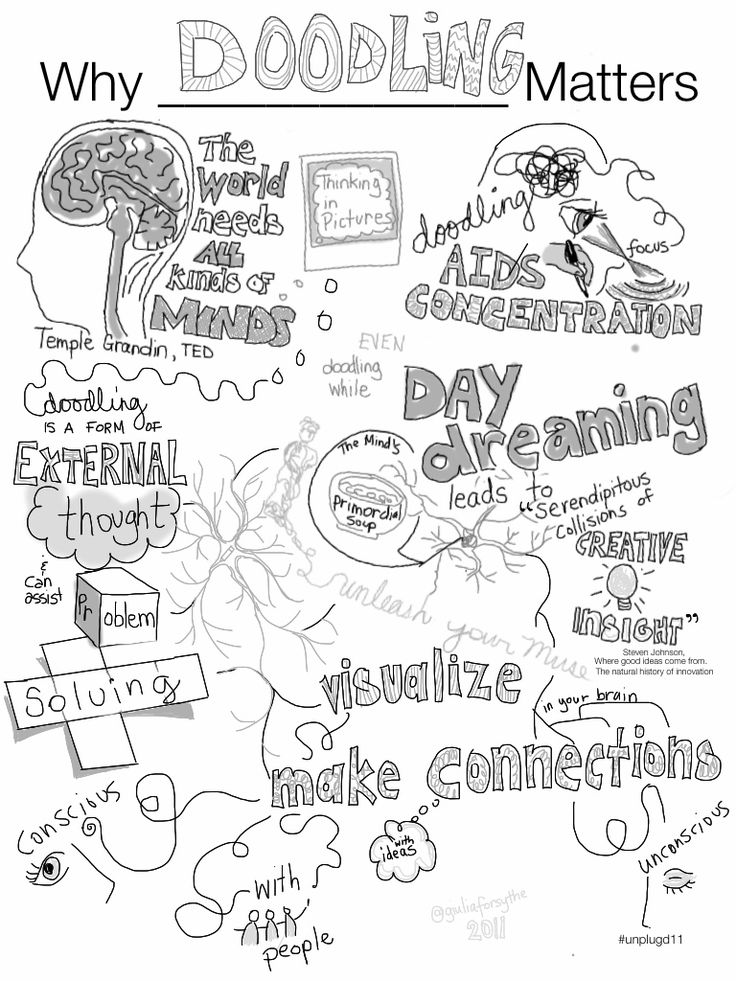

Why Doodling Issues (draft 1) Elementary Artwork Room Artwork

Why Doodling Issues (draft 1) Elementary Artwork Room Artwork

survival worksheets for college students in 2020 First help equipment

survival worksheets for college students in 2020 First help equipment